The Federal Tax Ombudsman Secretariat is seeking experienced professionals to join as Advisor and Assistant Advisor as per Section 20 of the FTO Ordinance 2000. This initiative aims to enhance regional complaint handling and administrative review of tax-related issues throughout Pakistan. Vacancies are available in various cities such as Islamabad, Karachi, Lahore, Peshawar, Quetta, Faisalabad, and more. Ideal candidates should possess a strong grasp of income tax, customs, sales tax, and federal excise matters, with prior experience in relevant government or semi-government departments. These roles are temporary for an initial six-month period, with the possibility of extension contingent on performance. Successful candidates will need to exercise discretion, demonstrate procedural clarity, and have a good understanding of tax administration.

These tax advisor positions in Pakistan are suitable for individuals with extensive experience in enforcement or adjudication, especially those with previous FBR or legal backgrounds, who wish to contribute to institutional integrity through policy oversight.

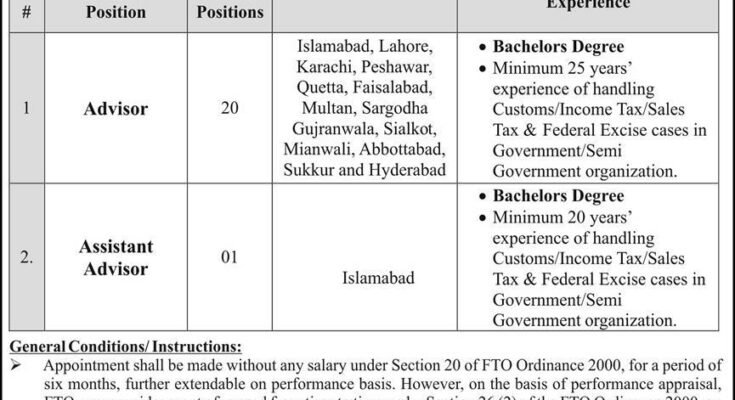

Job Position Details

| S# | Position Title | No. of Vacancies | Location/Placement | Minimum Qualification & Experience |

|---|---|---|---|---|

| 1 | Advisor | 20 | Islamabad, Lahore, Karachi, Peshawar, Quetta, Faisalabad, Multan, Sargodha, Gujranwala, Sialkot, Mianwali, Abbottabad, Sukkur, Hyderabad | Bachelor’s degree with at least 25 years of experience handling customs/income tax/sales tax/federal excise cases |

| 2 | Assistant Advisor | 1 | Islamabad | Bachelor’s degree with at least 20 years of experience in the same fields in government/semi-government organizations |

About the Federal Tax Ombudsman Secretariat (FTO)

The Federal Tax Ombudsman Secretariat is an official body established under the Government of Pakistan to tackle systemic issues and public complaints concerning the Federal Board of Revenue (FBR) and its affiliated entities. The Secretariat is authorized to probe maladministration in tax matters, ensure protection of taxpayer rights, and propose enhancements for effective service delivery.** FTO, through its legal mandate, operates as an independent entity to ensure accountability within tax administration, correct policy misapplications, and enhance administrative processes affecting taxpayers nationwide. The organization collaborates closely with legal experts, tax professionals, and former revenue and audit officers, maintaining integrity and transparency while providing fair hearings and remedies as per ordinance provisions. With this recruitment drive, the Secretariat aims to enhance operational efficiency in various regional settings.

✅ Eligibility Requirements

✅ Bachelor’s degree from a recognized institution with a minimum of 14–16 years of education

✅ Substantial experience (20–25 years, depending on the role) in tax-related domains

✅ Demonstrated expertise in the application of Customs, Income Tax, Sales Tax, or Excise Law in a regulatory or enforcement capacity

✅ Retired officials from FBR, Customs, or related services are eligible to apply if their experience aligns with the job requirements

* Duties & Obligations

For Advisors:

Review, analyze, and compile reports on complaints lodged against FBR departments

Assist in data analysis and conduct hearings as necessary

Collaborate with FTO officers, legal teams, and regional authorities

Ensure efficient management of complaints within specified ordinance timelines

For Assistant Advisors:

Offer analytical support and assist in documenting case summaries

Collaborate with legal staff to draft notices, summaries, and recommendations

Facilitate coordination with complainants and maintain records of activities

Conduct research, either on-field or desk-based, related to tax laws, directives, and notifications

* Terms & Conditions

* All appointments will be made in accordance with Section 20 of the FTO Ordinance 2000

⚖️ Appointments are unpaid and initially for a six-month term, with possible extensions based on performance

* The FTO reserves the right to consider fixed compensation tied to outcomes or value addition, at its discretion

✅ Government and semi-government employees must apply through the appropriate channels.****📤 Applications submitted in person will not be accepted; only online submissions will be considered valid.

* Only candidates who are shortlisted will be contacted for further proceedings.

* Applicants are required to upload a scanned copy of a valid CNIC and a passport-sized photograph during the online submission process.

* Travel Allowance/Daily Allowance will not be provided for interviews.

* How to Apply

* Online Portal: Visit www.fto.gov.pk/jobs.

Visit www.fto.gov.pk/jobs.* Complete the online application form, ensuring all mandatory fields are accurately filled out.

* Upload the following documents:

Updated resume

Scanned passport-sized photograph

Valid CNIC

Work experience and service record

Educational certificates

* Last Date to Apply:

Applications must be submitted within 15 days from the date of publication.

* � Contact Information

Muhammad Farhan Khan

Director (Admin)

Federal Tax Ombudsman Secretariat

5-A, Constitution Avenue,